10

M+

Customers Serviced

5

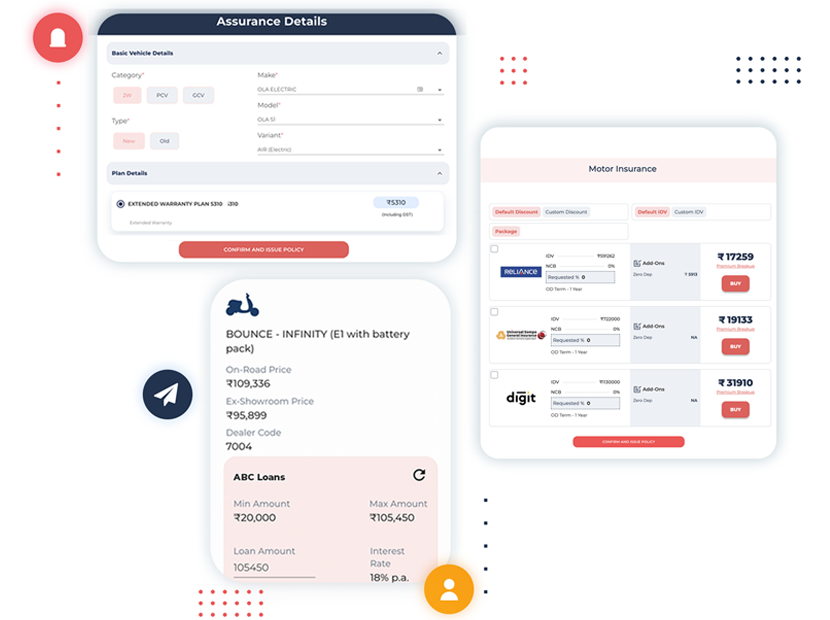

K+

Dealers & POS Merchants

20

+

OEM & Brand Partnership

12

+

Insurance Companies

6

+